Put option formula

Each may pose hazards to human health. The first component is equal to the difference between strike price and underlying price.

Options Are Financial Derivatives Mainly Of Two Types Call Option And Put Option We Must Understand These Concepts Fo Put Option Call Option Option Trading

Using the Black and Scholes option pricing model this calculator generates theoretical values and option greeks for European call and put options.

. Me and my co-worker were both back from maternity leave and wanted another option other than similac or powder formula we even noticed the organic ones didnt look healthy for a baby. As I understand in option put selling we do not pay the premium however we receive the premium. Formula One tyres play a significant role in the performance of a Formula One car.

The formulas for d 1 and d 2 are. Typically these options give their holders the right to purchase or sell an underlying debt. Active ingredients in sunscreens come in two forms mineral and chemical filters.

These products typically include a combination of two to six of these active ingredients. A put option put is a contract that gives the owner the option but not the requirement to sell a specific underlying security at a predetermined price strike price within a certain. Dividend yield was only added by Merton in Theory of Rational Option Pricing 1973.

Each uses a different mechanism for protecting skin and maintaining stability in sunlight. Vega greek Vega ν is an option Greek that measures the sensitivity of an option price relative to the volatility of the underlying asset. Now we have created simple payoff calculators for call and put options.

Toggle navigation Option Calculator. Sign up for our daily and breaking newsletters for the top SA. The strike price is 60.

Cboe provides the PCR for a number of indexes and products. As you can see from the examples above a long put option trades total profit or loss depends on two things. The formula for gamma function can be derived by using a number of variables which include asset dividend yield applicable for dividend-paying stocks spot price strike price standard deviation options Time to expiration and the risk-free rate of return Risk-free Rate Of Return A risk-free rate is the minimum rate of return expected.

The most common sunscreens on the market contain chemical filters. Subscribe for more Accounting Tutorials httpsgeniussubtothechannelEverything you need to know about the Invoice. Call and Put Option Price Formulas.

A put option contract gives the option buyer the right to sell a contract at a particular price. The calculation of the PL and intrinsic value does matter and there is a different formula to do the same. The general formula for calculating the borders is strike price plus or minus the sum of the two option premiums in our example 35 2 2 31 and 35 2 2 39.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. This value can approximate the theoretical value produced by BlackScholes. Both options are currently trading at 2 per share or 200 for one option contract representing 100 shares of the underlying stock.

Selling a 35 strike put option. If the put option is trading for 691 then the put and call option can be said to be at parity. In this episode of Accounting Basic.

Stock XYZ is trading for 60. Pricing a European Put Option Formula. Thank you for reading CFIs guide on Put-Call Ratio PCR.

The result with the inputs shown above 45 235 41 should be 165. A call option is an agreement that gives an investor the right but not the obligation to buy a stock bond commodity or other instrument at a specified price within a specific time. Call option C and put option P prices are calculated using the following formulas.

A benchmark index for the performance of a cash-secured short put option position is the CBOE SP 500 PutWrite Index ticker PUT. In the option put selling you have given formula P L Premium Paid-Max0strike price-spot price. 130 Options Contract Definition.

Practical Example of European Option. The lower underlying. The put option profit or loss formula in cell G8 is.

Read about its intrinsic value PL payoff etc. If the option s gamma is 10 after a 1 point increase in the securitys price the delta would become 06 and after the 2 point increase the. Where Nx is the standard normal cumulative distribution function.

Put Option Payoff Formula. To put this more clearly let me assume two situations on the Bank Nifty Trade. If the volatility of.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Where cells G4 G5 G6 are strike price initial price and underlying price respectively. Put-Call Ratio in the Market.

News about the San Antonio Spurs. Volatility is 10 and the risk-free rate is 5. As of July 12 2019 the index PCR was 115 and the exchange-traded funds PCR was 132.

Put Call Parity Formula Example 2 The stock of a company XYZ Ltd is trading in the stock market for 300 as of 01042019. A derivative financial instrument in which the underlying asset is a debt security. This was introduced after the first race of the season when confusion occurred because a small dot was put on the sidewall of the tyre instead of the white stripe.

Putcall parity is a static replication and thus requires minimal assumptions namely the existence of a forward contractIn the absence of traded forward contracts the forward contract can be replaced indeed itself replicated by the ability to buy the underlying asset and finance this by borrowing for fixed term eg borrowing bonds or conversely to. I have been breastfeeding 6 times a. The option tyre had two thick coloured lines between the Pirelli and P Zero logos of each.

Put 2 cups filtered water into a pyrex measuring pitcher and remove 2 tablespoons that will give you 1-78 cups water. What you have paid for the option in the beginning. A put options time value which is an extra premium that an investor will pay above the options intrinsic value can also affect the options value.

As in the BlackScholes model a simple formula can be used to find the option price at each node in the tree. Price Put Xe-rt 1-Nd 2 P 0 1-Nd 1 Where d 1 and d 2 can be calculated in the same way as in the pricing of call option explained above. GammaHow Delta is expected to change given a 1 move in the.

However there are still some things we. The Put Option seller will experience a profit to the extent of premium received as and when the spot price trades above the strike price. Please contact Savvas Learning Company for product support.

What you can get when exercising the option.

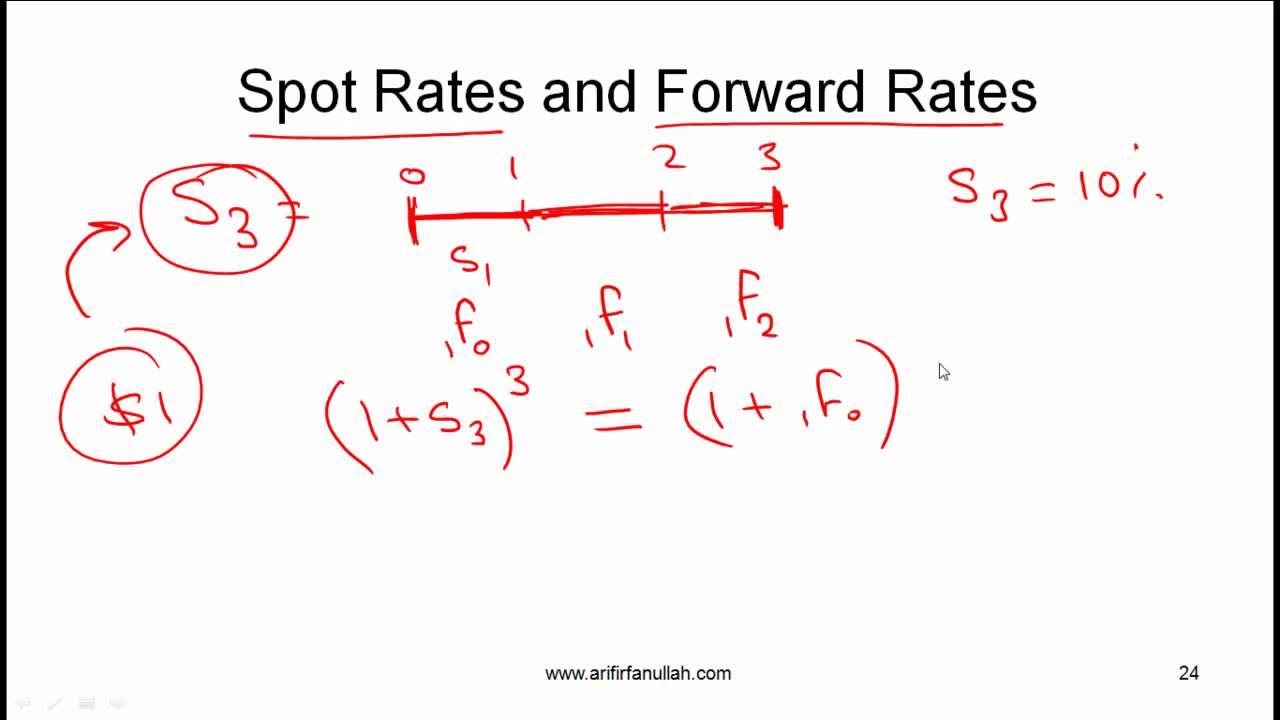

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Icse Soiutions For Class 10 Mathematics Factorization Maths Formula Book Mathematics Math Methods

Options Trading Terminology Are Explained In Hindi We Will Also See Option Chain With Call And Put Option On Nse Website To Option Trading Put Option Trading

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

Put And Call Options Simply Explained By Bill Bill Poulos Of Profits Run Offers Simple Explanations So That Ever Call Option Option Trading Financial Education

Among The Best Chart Patterns I Ve Discovered For Straddle Option Trade Opportunities Are What Are Commonly Known Option Trading Option Strategies Strategies

Markup Percent Calculations Excel Calculator Page Layout

Pin By Anand Masurkar On Stock Market Quotes Stock Market Quotes Marketing Meme Stock Market

Tom S Tutorials For Excel Converting All Formula Cell References From Relative To Absolute Excel Tutorials Excel Tutorial

Selina Concise Mathematics Class 9 Icse Solutions Compound Interest Without Using Formula A Plus Topper Hydrogen C Mathematics Compound Interest Solutions

Call Put Parity Explained For Begineers Youtube Risk Management Option Trader Option Strategies

Class 9 Maths Solution

First Week Of November 20th Options Trading For Tata Motors Ttm Option Trading Trading Call Option

Options Pricing Option Pricing Pricing Formula Call Option

Selina Concise Mathematics Class 9 Icse Solutions Compound Interest Using Formula A Plus Topper Student Problem Solving Physics Books Mathematics

Rd Sharma Class 11 Solutions Chapter 23 Straight Lines Ex 23 15 Math Vocabulary Solutions Class

Put Call Parity Refers To The Static Price Relationship Between The Prices Of Put And Call Options Of An Asset With Th Exam Fisher College Of Business Formula